Exploring the necessity of professional liability insurance for businesses unveils a world of protection against unforeseen risks and potential legal challenges. Dive into this informative discussion to understand why this coverage is essential for safeguarding your business.

As we delve deeper, you will uncover valuable insights into the importance of professional liability insurance, the coverage it offers, industries that benefit from it, legal requirements, and cost considerations.

Importance of Professional Liability Insurance

Professional liability insurance is crucial for businesses to protect themselves from potential legal and financial risks that may arise from claims of errors, negligence, or failure to perform professional duties. Without this insurance, businesses are exposed to various consequences that can have detrimental effects on their reputation and bottom line.One of the main risks of not having professional liability insurance is the potential for costly lawsuits.

In the event that a client or customer files a claim against your business for errors or omissions in the services provided, the legal expenses alone can be overwhelming. Additionally, without insurance coverage, businesses may have to pay out substantial settlements or judgments, which could lead to financial strain or even bankruptcy.For example, imagine a software development company that fails to deliver a project on time due to a mistake in the coding process.

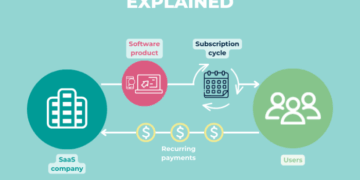

As a result, the client suffers financial losses and decides to sue the company for negligence. Without professional liability insurance, the software development company would have to bear the full legal costs and potential damages awarded to the client.Professional liability insurance differs from general liability insurance in that it specifically covers claims related to professional services rendered by the business.

While general liability insurance protects against bodily injury, property damage, and advertising injury, professional liability insurance focuses on claims of errors, negligence, or failure to perform professional duties. This specialized coverage is essential for businesses that provide professional services or advice to clients, as it offers protection against risks that are unique to their industry.

Coverage Offered

Professional liability insurance, also known as errors and omissions insurance, typically covers claims related to negligence, misrepresentation, violation of good faith, and inaccurate advice or services provided by a business. This type of insurance is crucial for businesses that provide professional services or advice to clients.

Types of Claims Covered

- Professional negligence

- Misrepresentation

- Violation of good faith

- Inaccurate advice or services

Limits of Coverage and Exclusions

Professional liability insurance policies come with limits of coverage, which is the maximum amount the insurer will pay out for a claim. It's essential to review these limits carefully to ensure they align with the potential risks faced by your business.

Additionally, certain exclusions may apply, such as intentional wrongdoing, criminal acts, or claims outside the policy period.

Comparison of Coverage Options

When considering professional liability insurance, it's crucial to compare coverage options from different providers. Look at factors such as coverage limits, premiums, deductibles, and additional benefits offered. Some providers may offer tailored policies for specific professions or industries, so it's essential to choose a policy that best suits your business needs.

Industries that Need Professional Liability Insurance

Professional liability insurance is crucial for a wide range of industries where businesses or individuals provide professional services. This type of insurance can protect against claims of negligence, errors, or omissions that could result in financial loss or damage to clients.

Let's explore some industries and specific professions that greatly benefit from having professional liability coverage.

Medical and Healthcare

- Doctors

- Nurses

- Pharmacists

Medical professionals face high risks of malpractice claims, making professional liability insurance essential in the healthcare industry.

Legal Services

- Lawyers

- Paralegals

- Legal consultants

Legal professionals can be sued for errors in legal advice or representation, highlighting the need for professional liability coverage in the legal sector.

Consulting and Advisory

- Management consultants

- Financial advisors

- HR consultants

Consultants and advisors can face lawsuits due to recommendations or advice that lead to financial losses, emphasizing the importance of professional liability insurance in this industry.

Legal Requirements and Regulations

Professional liability insurance is not always a choice for businesses, as there are legal mandates and industry regulations that require certain businesses to have this coverage in place. Failure to comply with these regulations can result in fines, penalties, or even legal action against the business.

It is crucial for businesses to understand and adhere to these requirements to avoid any negative consequences.

Compliance Impact on Business

- Businesses in certain industries, such as healthcare, legal, and financial services, are often required by law to carry professional liability insurance to protect clients and stakeholders.

- Compliance with legal requirements can enhance the credibility and trustworthiness of a business in the eyes of clients and partners.

- Having professional liability insurance in place can also provide a safety net for businesses in case of legal claims or disputes.

Staying Updated with Legal Requirements

- Regularly consult with legal counsel or insurance professionals to stay informed about any changes or updates to legal requirements related to insurance.

- Attend industry seminars, workshops, or conferences to stay updated on evolving regulations and compliance standards.

- Subscribe to industry publications or newsletters that provide insights into legal changes affecting insurance requirements.

Cost Considerations

When it comes to professional liability insurance, the cost can vary depending on several factors. Understanding what influences the cost and how businesses can manage and reduce insurance expenses is crucial for making informed decisions. Here are some insights on cost considerations:

Factors Influencing Cost

- Industry Risk: Some industries are considered riskier than others, leading to higher premiums.

- Business Size: The size of the business and revenue can impact the cost of insurance.

- Claims History: A history of past claims may result in higher premiums.

- Coverage Limits: Higher coverage limits typically lead to higher costs.

- Location: The location of the business can also affect insurance costs.

Tips to Manage and Reduce Costs

- Review Coverage Needs: Assess your business's specific risks to ensure you are not overpaying for coverage you may not need.

- Compare Quotes: Obtain quotes from multiple insurance providers to find the best rates.

- Implement Risk Management Practices: Proactively managing risks can help reduce the likelihood of claims and lower insurance costs.

- Consider Bundling Policies: Some insurance companies offer discounts for bundling multiple policies.

Cost-Effective Coverage Options

- Choose a Higher Deductible: Opting for a higher deductible can lower premiums, but be sure you can afford the deductible if a claim arises.

- Explore Professional Associations: Some professional associations offer group insurance plans at discounted rates.

- Work with an Independent Agent: Independent insurance agents can help you find cost-effective coverage options tailored to your business needs.

Last Point

In conclusion, professional liability insurance is not just a safety net but a strategic asset for your business. With the right coverage in place, you can navigate uncertainties with confidence and focus on growth. Make informed decisions to protect your business's future today.

Essential FAQs

What risks do businesses face without professional liability insurance?

Businesses without professional liability insurance risk financial losses from potential lawsuits, negligence claims, or errors in services provided. This coverage acts as a shield against such liabilities.

What types of claims are typically covered by professional liability insurance?

Professional liability insurance typically covers claims related to professional errors, negligence, malpractice, or failure to perform services as promised. It does not cover bodily injury or property damage claims.

Are there industries where professional liability insurance is crucial?

Industries such as healthcare, legal, consulting, and technology rely heavily on professional liability insurance due to the nature of their services and the potential risks involved.

How can businesses manage and reduce insurance costs?

Businesses can manage insurance costs by assessing their risks accurately, maintaining a good claims history, bundling policies, and exploring discounts offered by insurance providers.