Delve into the realm of New Insurance Models for Startup Ecosystems, where traditional meets cutting-edge to cater specifically to the needs of burgeoning startups. This introduction sets the stage for a riveting exploration of how insurance models are evolving to support the dynamic startup landscape.

Unveiling the intricate balance between tradition and innovation, this paragraph captivates readers with a glimpse into the transformative world of insurance for startups.

Overview of New Insurance Models for Startup Ecosystems

Insurance models tailored for startups are designed to address the specific needs and challenges faced by these emerging businesses. Unlike traditional insurance models that may not fully meet the unique requirements of startups, new models offer more flexibility, affordability, and customization.

Traditional Insurance Models vs. Innovative Ones

Traditional insurance models often come with rigid policies and high premiums, which can be burdensome for startups with limited resources. On the other hand, innovative insurance models for startup ecosystems offer features such as pay-as-you-go plans, on-demand coverage, and risk-sharing arrangements.

These new models are more aligned with the dynamic nature of startups and provide better scalability options.

Importance of Adapting Insurance Models

Adapting insurance models to meet the needs of startups is crucial for ensuring their sustainability and growth. By offering tailored solutions that address the specific risks and challenges faced by startups, insurance providers can help these businesses mitigate potential threats and focus on innovation and development.

Moreover, customized insurance models can foster a more supportive ecosystem for startups, encouraging entrepreneurship and investment in new ventures.

Challenges Faced by Startups in Obtaining Insurance

Startups often face numerous challenges when it comes to obtaining insurance coverage, which can significantly impact their ability to operate and grow. These challenges arise from various factors, including the unique nature of startups, the lack of financial history, and the uncertainty associated with their business models.

Limited Options and Coverage

One of the main challenges for startups is the limited options available to them when it comes to insurance providers and coverage. Traditional insurance companies may not offer policies tailored to the specific needs of startups, leading to gaps in coverage or paying for unnecessary services.

High Costs and Financial Constraints

Another significant challenge is the high cost of insurance premiums for startups. With limited financial resources, startups may struggle to afford the necessary insurance coverage, which can put their business at risk in case of unforeseen events or liabilities.

Inflexible Requirements and Underwriting Processes

Traditional insurance models often have rigid requirements and underwriting processes that startups may find difficult to meet. This can lead to delays in obtaining coverage or even denial of insurance, further complicating the situation for startups.

Emerging Trends in Insurance Products for Startup Ecosystems

As the startup ecosystem continues to evolve, new trends in insurance products are emerging to cater to the specific needs of startups. These innovative insurance solutions offer a more tailored approach compared to traditional offerings, providing startups with the flexibility and coverage they require to navigate the challenges of entrepreneurship.

Customizable Insurance Solutions

One of the key emerging trends in insurance products for startups is the focus on customizable solutions. Startups often have unique risks and requirements that may not be adequately addressed by standard insurance policies. Customizable insurance solutions allow startups to select and pay for only the coverage they need, eliminating unnecessary costs and ensuring comprehensive protection.

Usage-based Insurance Policies

Another trend in insurance products for startups is the adoption of usage-based insurance policies. These policies are designed to adjust premiums based on the actual usage or risk exposure of the insured item. For startups with fluctuating needs or limited resources, usage-based policies offer a more cost-effective and flexible option compared to traditional fixed-rate premiums.

Peer-to-Peer Insurance Platforms

Peer-to-peer insurance platforms are also gaining popularity in the startup ecosystem. These platforms allow startups to pool resources with other similar businesses to create a self-insurance fund. By leveraging the collective risk-sharing model, startups can access more affordable insurance coverage while maintaining control over their premiums and claims process.

Collaborations between Insurtech Companies and Startups

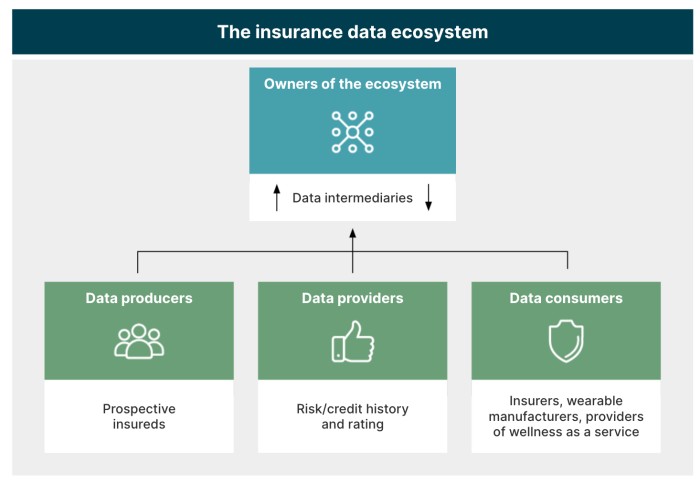

In the fast-evolving landscape of insurance, collaborations between insurtech companies and startups play a crucial role in driving innovation and creating new insurance models tailored to the needs of startup ecosystems.

Innovative Insurance Solutions

Collaborations between insurtech companies and startups have led to the development of innovative insurance solutions that address the unique challenges faced by startups. For example, partnerships between insurtech firms specializing in data analytics and startups focusing on IoT devices have resulted in customized insurance products that leverage real-time data to assess risk and offer personalized coverage.

Driving Evolution of Insurance Models

These partnerships not only bring together complementary expertise but also foster a culture of experimentation and agility within the insurance industry. By combining the technological prowess of insurtech companies with the entrepreneurial spirit of startups, new insurance models are continuously being refined and adapted to meet the changing needs of startup ecosystems.

The collaborative efforts between insurtech companies and startups are reshaping traditional insurance practices and paving the way for more flexible, efficient, and customer-centric insurance solutions.

Conclusive Thoughts

In conclusion, the realm of New Insurance Models for Startup Ecosystems is a tapestry of adaptability and foresight, ensuring startups have the necessary safeguards to thrive. As we bid adieu to this discussion, the future shines bright with possibilities for insurance solutions tailored to the unique needs of startups.

Commonly Asked Questions

What are some examples of innovative insurance models for startups?

Innovative insurance models for startups include on-demand insurance, peer-to-peer insurance, and usage-based insurance tailored to the specific needs of startup ecosystems.

How do high insurance costs impact the sustainability of startups?

High insurance costs can significantly burden startups, affecting their financial health and hindering their growth potential due to the drain on resources.

What benefits do customizable insurance solutions offer to startups?

Customizable insurance solutions provide startups with flexibility, cost-effectiveness, and tailored coverage that aligns with their unique risks and operational requirements.