Embark on a journey through the essential Must-Have Insurance Policies for New LLCs, exploring the vital aspects that every new business owner should be aware of. From understanding different insurance types to customizing policies, this guide provides a roadmap to safeguarding your LLC's future success.

Delve into the nuances of insurance selection and compliance, ensuring your LLC is well-equipped to handle any unforeseen challenges that may arise.

Types of Insurance Policies

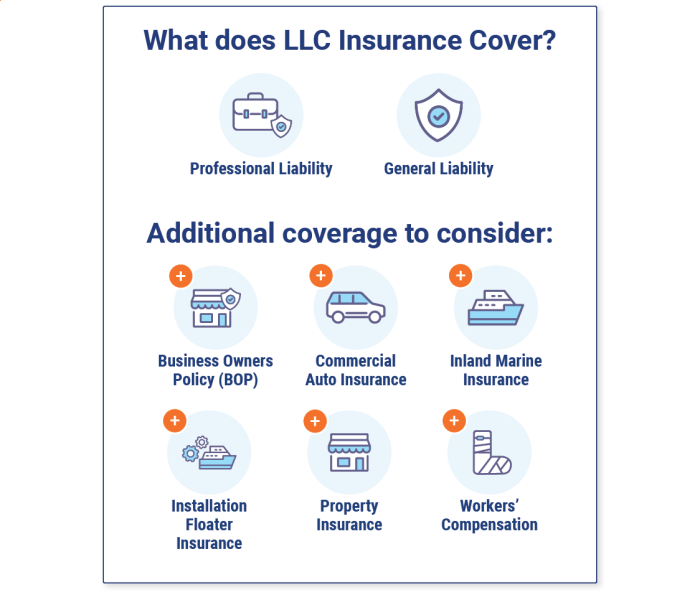

When starting a new LLC, it is essential to consider various insurance policies to protect your business from unforeseen risks and liabilities. Here, we will explore the key types of insurance policies available for new LLCs and their features and benefits.

General Liability Insurance

General liability insurance is a fundamental policy that provides coverage for third-party bodily injury, property damage, and advertising injury claims. This type of insurance protects your business from lawsuits and financial losses resulting from accidents or negligence. Key features of general liability insurance include:

- Coverage for legal fees and settlements

- Protection against claims of slander or libel

- Medical payments coverage for injuries on your premises

Property Insurance

Property insurance is crucial for protecting your business assets, including buildings, equipment, inventory, and other physical property. This insurance policy covers losses due to fire, theft, vandalism, or natural disasters. Key features of property insurance include:

- Replacement cost coverage for damaged or stolen property

- Business interruption coverage for lost income during repairs

- Protection for equipment breakdowns

Workers’ Compensation Insurance

Workers' compensation insurance is mandatory in most states and provides coverage for employees' medical expenses and lost wages due to work-related injuries or illnesses. This policy protects your business from potential lawsuits and ensures that your employees are taken care of.

Key features of workers' compensation insurance include:

- Coverage for medical treatment and rehabilitation costs

- Income replacement for employees unable to work due to injuries

- Legal protection against employee lawsuits related to workplace injuries

Legal Requirements and Compliance

When starting a new LLC, it is crucial to understand the legal requirements for insurance policies to ensure compliance with state regulations and laws. Insurance plays a vital role in protecting the business, its assets, employees, and customers from various risks and liabilities.

Failure to have the necessary insurance coverage can have serious consequences for an LLC, including legal penalties, financial losses, and even the potential closure of the business.

Overview of Legal Requirements

In most states, there are specific insurance requirements that LLCs must meet to operate legally. These requirements often include general liability insurance, workers' compensation insurance, professional liability insurance, and commercial auto insurance, depending on the nature of the business. Failing to obtain the required insurance coverage can result in fines, lawsuits, and other legal repercussions.

Compliance with State Regulations

Having the right insurance policies in place can help an LLC comply with state regulations and laws by providing the necessary protection against potential risks. For example, workers' compensation insurance is mandatory in most states to cover medical expenses and lost wages for employees injured on the job.

By having this insurance, an LLC can avoid legal issues and ensure compliance with state laws.

Consequences of Not Having Insurance Coverage

The consequences of not having the necessary insurance coverage for an LLC can be severe. Without adequate protection, the business may be vulnerable to lawsuits, claims, and financial losses that could jeopardize its operations. In addition, non-compliance with state regulations regarding insurance can lead to fines, penalties, and even the revocation of the LLC's operating license.

It is essential for new LLCs to prioritize obtaining the right insurance coverage to protect their business and ensure compliance with legal requirements.

Risk Assessment and Coverage Needs

As a new LLC owner, it is crucial to assess your business risks in order to determine the necessary insurance coverage. Understanding the factors that influence your insurance coverage needs will help you prioritize the protection of your business.

Factors Influencing Insurance Coverage Needs

- Industry: Different industries have varying levels of risk exposure. Assess how your industry's specific risks could impact your business.

- Business Assets: Evaluate the value of your business assets, including equipment, inventory, and intellectual property, to determine the appropriate coverage.

- Revenue Size: Consider your LLC's revenue size as it can impact the level of liability protection you may need.

- Location: Take into account your business location and any regional risks that could affect your operations.

Step-by-Step Process for Identifying Coverage Needs

- Conduct a Risk Assessment: Identify potential risks that could impact your LLC, such as property damage, liability claims, or cyber threats.

- Evaluate Current Coverage: Review any existing insurance policies to determine gaps in coverage that need to be addressed.

- Consult with an Insurance Professional: Seek guidance from an insurance agent or broker to help you understand the specific coverage options available for your business.

- Prioritize Coverage: Based on your risk assessment and budget, prioritize the insurance coverage that is essential for protecting your LLC.

Insurance Policy Selection and Customization

When it comes to selecting insurance policies for your new LLC, it is crucial to consider the specific needs and risks of your business. Customizing your insurance coverage is essential to ensure that you are adequately protected in case of any unforeseen events.

Here are some tips on how to choose and customize insurance policies for your new LLC:

Customizing Insurance Policies

When customizing your insurance policies, it is important to assess the unique risks that your LLC faces. Consider the nature of your business, the industry you operate in, and any potential liabilities that may arise. By tailoring your insurance coverage to address these specific risks, you can ensure that you have the right protection in place.

- Adding Professional Liability Insurance: If your LLC provides professional services, consider adding professional liability insurance to protect against claims of negligence, errors, or omissions.

- Employment Practices Liability Insurance (EPLI): This coverage can help protect your LLC against claims of discrimination, wrongful termination, harassment, or other employment-related issues.

- Cyber Liability Insurance: In today's digital age, cyber threats are a growing concern for businesses. Cyber liability insurance can help cover the costs associated with data breaches, cyber-attacks, and other cyber incidents.

Last Word

As we conclude our discussion on Must-Have Insurance Policies for New LLCs, remember that securing the right insurance coverage is not just a legal requirement but a strategic investment in the longevity of your business. By prioritizing risk assessment and coverage needs, you can proactively protect your LLC from potential liabilities and uncertainties.

Top FAQs

What are the key features of general liability insurance?

General liability insurance typically covers third-party bodily injury, property damage, and advertising injury claims. It provides financial protection in case your business is sued for negligence.

How can insurance help LLCs comply with state regulations?

Insurance helps LLCs comply with state regulations by ensuring they have the required coverage mandated by law, such as workers' compensation or professional liability insurance.

What are some optional coverage examples for new LLCs?

Optional coverage examples include cyber liability insurance, business interruption insurance, and commercial auto insurance, depending on the nature of your LLC's operations.