Beginning with Financial Security for Startup Teams: Insurance Solutions, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

As startups navigate the dynamic landscape of entrepreneurship, ensuring financial security through appropriate insurance solutions becomes a critical aspect of their success. This guide delves into the realm of insurance for startup teams, shedding light on the importance, types of coverage, considerations for choosing providers, and effective budgeting strategies.

Importance of Insurance for Startup Teams

Financial security is crucial for startup teams as it provides a safety net against unexpected events that could disrupt operations and hinder growth. Insurance plays a vital role in safeguarding businesses from various risks and uncertainties.

Potential Risks Faced by Startup Teams Without Insurance

- Lack of protection against property damage or loss due to natural disasters or accidents.

- Liability issues arising from product defects, accidents, or legal disputes.

- Financial strain from medical expenses in case of employee injuries or illnesses.

- Loss of key personnel leading to operational disruptions and decreased productivity.

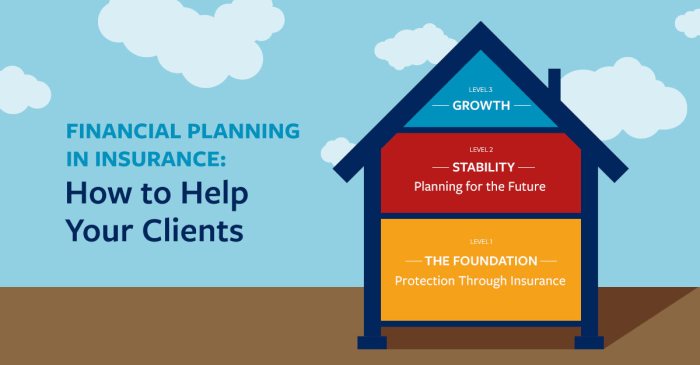

Impact of Insurance on the Stability and Growth of Startups

- Insurance provides financial security by covering the costs associated with unexpected events, reducing the financial burden on startup teams.

- Enhanced credibility and trust with stakeholders, investors, and clients, showcasing a commitment to risk management and responsible business practices.

- Facilitates business continuity by ensuring that operations can resume quickly after a disruptive event, minimizing downtime and revenue loss.

- Promotes a culture of risk awareness and mitigation within the startup team, fostering a proactive approach to addressing potential threats.

Types of Insurance Coverage for Startup Teams

When it comes to protecting your startup team, there are several types of insurance coverage options to consider. Each type of insurance serves a specific purpose and can help safeguard your team against various risks.

Health Insurance

Health insurance is essential for startup teams to ensure that employees have access to medical care when needed. This type of insurance can cover a range of medical expenses, including doctor visits, hospital stays, and prescription medications. By providing health insurance, startups can attract top talent and promote the well-being of their team members.

Liability Insurance

Liability insurance protects startup teams from legal claims and financial losses resulting from accidents, injuries, or negligence. This type of insurance can cover legal fees, settlements, and damages awarded in lawsuits. It is crucial for startups to have liability insurance to protect their assets and reputation in case of unforeseen events.

Property Insurance

Property insurance helps safeguard startup teams' physical assets, such as office space, equipment, and inventory. This type of insurance can cover losses due to theft, fire, vandalism, or natural disasters. By having property insurance, startups can protect their investments and ensure business continuity in the face of unexpected events.

Tailoring Insurance Coverage

It is important for startup teams to tailor their insurance coverage to meet their specific needs and risks. By assessing the unique challenges faced by the team and the nature of the business, startups can choose the right combination of insurance policies to provide comprehensive coverage.

Working with an experienced insurance agent can help startups customize their insurance plans to address their specific requirements.

Considerations for Choosing Insurance Providers

When it comes to choosing insurance providers for your startup team, there are several factors to consider to ensure you are getting the right coverage for your specific needs. Researching and comparing insurance policies from different providers is crucial in making an informed decision.

Insurance brokers can also play a valuable role in helping startup teams navigate the complex world of insurance and find suitable solutions tailored to their unique circumstances.

Factors to Consider

- Reputation and Financial Stability: Look for insurance providers with a solid reputation and financial stability to ensure they can meet their obligations in the event of a claim.

- Coverage Options: Evaluate the range of coverage options offered by different providers and choose one that aligns with your startup team's specific needs and risks.

- Cost and Affordability: Compare premiums and deductibles from different providers to find a balance between cost and coverage that fits within your startup team's budget.

- Customer Service: Consider the quality of customer service provided by insurance providers, as this can greatly impact your experience when filing claims or seeking assistance.

Budgeting and Financial Planning for Insurance

When it comes to budgeting and financial planning for insurance, startup teams need to carefully consider their priorities and resources to ensure adequate coverage without overspending. Incorporating insurance costs into the overall financial plan is crucial for protecting the business and its team members.

Strategies for Budgeting and Incorporating Insurance Costs

One effective strategy for budgeting is to assess the specific risks that the startup faces and prioritize insurance coverage accordingly. By identifying the most critical areas that require protection, teams can allocate their financial resources efficiently.

- Opt for essential coverage: Start by investing in basic insurance policies that are crucial for the business, such as general liability insurance and property insurance.

- Review and adjust coverage annually: As the startup grows and evolves, it's essential to revisit insurance needs regularly and make adjustments to coverage levels to ensure adequate protection.

- Seek bundled insurance packages: Some insurance providers offer bundled packages that combine multiple types of coverage at a discounted rate, providing cost savings for startups.

Tips for Optimizing Insurance Coverage while Managing Costs Effectively

Optimizing insurance coverage involves striking a balance between comprehensive protection and cost-effectiveness. Here are some tips to achieve this balance:

- Compare quotes from multiple providers: Shopping around for insurance quotes allows startup teams to find the best coverage options at competitive rates.

- Consider higher deductibles: Opting for higher deductibles can lower insurance premiums, making coverage more affordable while still providing adequate protection.

- Implement risk management strategies: Proactively managing risks within the business can reduce the likelihood of insurance claims and lower overall insurance costs over time.

Long-Term Benefits of Proactive Financial Planning

Proactive financial planning goes hand in hand with insurance coverage for startup teams, offering long-term benefits that extend beyond immediate cost savings:

- Financial stability: By incorporating insurance costs into the financial plan, startups can better prepare for unexpected events and maintain financial stability during challenging times.

- Growth opportunities: Adequate insurance coverage provides a solid foundation for growth, giving startup teams the confidence to pursue new opportunities without worrying about potential risks.

- Peace of mind: Knowing that the business is well-protected through comprehensive insurance coverage allows team members to focus on innovation and growth, rather than concerns about potential liabilities.

Closing Summary

As the discussion on Financial Security for Startup Teams: Insurance Solutions comes to a close, it's evident that safeguarding the financial well-being of a startup team is not just a precautionary measure but a strategic move towards sustainable growth. By understanding the nuances of insurance solutions and implementing thoughtful financial planning, startup teams can fortify their foundation and thrive in the competitive business landscape.

Question Bank

Why is insurance important for startup teams?

Insurance provides a safety net against unforeseen risks and liabilities, ensuring the financial stability and longevity of a startup.

What are the key types of insurance coverage for startup teams?

Startup teams typically require health insurance, liability insurance, and property insurance to cover various aspects of their operations and assets.

How can startup teams tailor insurance coverage to their specific needs?

By assessing their unique risks and requirements, startup teams can customize insurance policies to address the most critical areas of concern within their business.

What factors should startup teams consider when selecting insurance providers?

Startup teams should evaluate the provider's reputation, coverage options, pricing, and customer service to make an informed decision about their insurance partner.

Why is proactive financial planning crucial for insurance in startup teams?

Proactive financial planning allows startup teams to anticipate future needs, optimize coverage, and manage costs effectively, ensuring long-term benefits and sustainability.