Exploring the contrasts between Embroker and traditional insurers unveils a world of innovation and evolution in the insurance industry. From business models to customer experience, let's delve into the key disparities that set Embroker apart.

As we navigate through the intricacies of technology integration, customer experience, and product offerings, the distinctiveness of Embroker's approach becomes clearer, painting a picture of a disruptor in the traditional insurance landscape.

Embroker vs Traditional Insurers: Key Differences

When it comes to insurance, there are two main players in the market - Embroker and traditional insurers. Each operates with distinct business models and features that set them apart from one another.

Concept of Embroker and Traditional Insurers

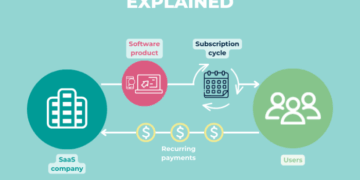

Embroker is a digital insurance platform that offers a streamlined and tech-savvy approach to purchasing and managing insurance policies. On the other hand, traditional insurers are more conventional companies that typically operate through brick-and-mortar offices and rely on manual processes.

Comparison of Business Models

- Embroker utilizes technology to provide a seamless online experience for customers, allowing for quick quotes, policy management, and claims processing.

- Traditional insurers often have a more complex and time-consuming process, involving paperwork, in-person meetings, and longer wait times for policy issuance and claims resolution.

Key Features Differentiating Embroker

- Embroker offers a more transparent pricing structure, allowing customers to see exactly what they are paying for and adjust coverage as needed.

- Traditional insurers may have hidden fees and charges, making it challenging for customers to understand the full cost of their insurance.

- Embroker provides access to a wide range of insurance products from multiple carriers, giving customers more options to tailor coverage to their specific needs.

Disruption by Embroker in the Insurance Industry

Embroker's innovative approach to insurance has disrupted the traditional industry by challenging outdated practices and pushing for greater efficiency and customer-centricity. This disruption has forced traditional insurers to adapt and improve their processes to stay competitive in the evolving market.

Technology Integration

Embroker's innovative approach includes a strong emphasis on technology integration to streamline processes and enhance customer experience.

Embroker’s Technology Integration

- Embroker's digital platform allows for easy online access to insurance policies, certificates, and claims.

- Automated underwriting processes help expedite policy issuance and renewal.

- Utilization of data analytics enables personalized risk assessment and tailored insurance solutions.

Comparison with Traditional Insurers

- Traditional insurers often rely on manual paperwork and face-to-face interactions, leading to longer processing times.

- Embroker's use of technology results in quicker response times and efficient communication with clients.

- Traditional insurers may struggle to provide the same level of customization and flexibility that technology-driven platforms like Embroker offer.

Enhanced Customer Experience

- Embroker's digital tools enable clients to access and manage their insurance portfolios conveniently from any device.

- Real-time updates and notifications keep clients informed about policy changes and claims status.

- Interactive risk assessment tools empower clients to make informed decisions about their coverage needs.

Impact on Efficiency

- Automation of routine tasks reduces the likelihood of errors and speeds up the overall insurance process.

- Data-driven insights help identify trends and potential risks, allowing for proactive risk management strategies.

- Technology integration enables seamless collaboration between clients, brokers, and insurers, leading to faster resolution of issues.

Customer Experience

When it comes to customer experience, the way insurance services are delivered can greatly impact satisfaction and loyalty. Let's explore how Embroker and traditional insurers differ in this aspect.

Embroker Personalization

Embroker stands out in personalizing its services for customers by leveraging technology to offer tailored solutions. Through data-driven insights, Embroker can better understand the unique needs of each client and provide customized insurance options that fit their specific requirements.

Ease of Use

- Embroker's digital platform offers a user-friendly interface that simplifies the insurance process, making it convenient for customers to manage their policies online. This streamlined approach enhances the overall experience and eliminates the hassle of traditional paperwork.

- In contrast, traditional insurers may still rely on manual processes and paperwork, leading to longer wait times and a more cumbersome experience for customers.

Customer Feedback

One Embroker customer praised the platform for its ease of use and transparency, stating, "Embroker made it so simple to understand my policy and make any necessary changes. It was a breath of fresh air compared to my previous experiences with traditional insurers."

On the other hand, a customer of a traditional insurer expressed frustration with the lengthy claims process and lack of communication, highlighting the need for improvement in customer service.

Product Offerings

When it comes to product offerings, Embroker and traditional insurers have differences in the range of insurance products they provide and how they cater to specific industries or sectors. Let's delve into the details.

Range of Insurance Products

Embroker offers a variety of insurance products, including but not limited to cyber insurance, directors and officers (D&O) liability insurance, errors and omissions (E&O) insurance, and employment practices liability insurance. On the other hand, traditional insurers typically offer a broader range of insurance products, covering everything from property and casualty to life and health insurance.

Unique or Specialized Insurance Products

Embroker stands out by offering unique and specialized insurance products tailored to specific industries or sectors. For example, Embroker provides customizable insurance solutions for technology startups, fintech companies, and professional service firms. This specialized approach allows Embroker to address the unique risks and challenges faced by these industries.

Pricing Strategies

In terms of pricing strategies, Embroker often leverages technology to streamline processes and offer competitive pricing to its customers. By utilizing data analytics and automation, Embroker can provide more accurate pricing based on individual risk profiles. Traditional insurers, on the other hand, may rely on more traditional underwriting methods, which can sometimes result in higher premiums.

Industry Specific Coverage

Embroker caters to a wide range of industries with its products, including technology, finance, healthcare, and professional services. By offering industry-specific coverage options, Embroker can provide tailored insurance solutions that address the unique needs of each sector. This targeted approach ensures that businesses receive comprehensive coverage that is relevant to their industry.

Final Conclusion

In conclusion, the comparison between Embroker and traditional insurers showcases a dynamic shift in how insurance services are delivered and experienced. With a focus on technology, customer-centric services, and a diverse range of products, Embroker stands out as a formidable force reshaping the insurance sector for the better.

FAQ

How does Embroker differ from traditional insurers?

Embroker distinguishes itself through its innovative business model that leverages technology to streamline insurance processes and enhance customer experience.

What unique insurance products does Embroker offer?

Embroker offers specialized insurance products tailored to specific industries or sectors, providing customized coverage options not typically found with traditional insurers.

How does technology impact the efficiency of insurance processes at Embroker?

Technology integration at Embroker significantly improves the efficiency of insurance processes, leading to quicker response times and smoother transactions for customers.

Exploring the contrasts between Embroker and traditional insurers unveils a world of innovation and evolution in the insurance industry. From business models to customer experience, let's delve into the key disparities that set Embroker apart.

As we navigate through the intricacies of technology integration, customer experience, and product offerings, the distinctiveness of Embroker's approach becomes clearer, painting a picture of a disruptor in the traditional insurance landscape.

Embroker vs Traditional Insurers: Key Differences

When it comes to insurance, there are two main players in the market - Embroker and traditional insurers. Each operates with distinct business models and features that set them apart from one another.

Concept of Embroker and Traditional Insurers

Embroker is a digital insurance platform that offers a streamlined and tech-savvy approach to purchasing and managing insurance policies. On the other hand, traditional insurers are more conventional companies that typically operate through brick-and-mortar offices and rely on manual processes.

Comparison of Business Models

- Embroker utilizes technology to provide a seamless online experience for customers, allowing for quick quotes, policy management, and claims processing.

- Traditional insurers often have a more complex and time-consuming process, involving paperwork, in-person meetings, and longer wait times for policy issuance and claims resolution.

Key Features Differentiating Embroker

- Embroker offers a more transparent pricing structure, allowing customers to see exactly what they are paying for and adjust coverage as needed.

- Traditional insurers may have hidden fees and charges, making it challenging for customers to understand the full cost of their insurance.

- Embroker provides access to a wide range of insurance products from multiple carriers, giving customers more options to tailor coverage to their specific needs.

Disruption by Embroker in the Insurance Industry

Embroker's innovative approach to insurance has disrupted the traditional industry by challenging outdated practices and pushing for greater efficiency and customer-centricity. This disruption has forced traditional insurers to adapt and improve their processes to stay competitive in the evolving market.

Technology Integration

Embroker's innovative approach includes a strong emphasis on technology integration to streamline processes and enhance customer experience.

Embroker’s Technology Integration

- Embroker's digital platform allows for easy online access to insurance policies, certificates, and claims.

- Automated underwriting processes help expedite policy issuance and renewal.

- Utilization of data analytics enables personalized risk assessment and tailored insurance solutions.

Comparison with Traditional Insurers

- Traditional insurers often rely on manual paperwork and face-to-face interactions, leading to longer processing times.

- Embroker's use of technology results in quicker response times and efficient communication with clients.

- Traditional insurers may struggle to provide the same level of customization and flexibility that technology-driven platforms like Embroker offer.

Enhanced Customer Experience

- Embroker's digital tools enable clients to access and manage their insurance portfolios conveniently from any device.

- Real-time updates and notifications keep clients informed about policy changes and claims status.

- Interactive risk assessment tools empower clients to make informed decisions about their coverage needs.

Impact on Efficiency

- Automation of routine tasks reduces the likelihood of errors and speeds up the overall insurance process.

- Data-driven insights help identify trends and potential risks, allowing for proactive risk management strategies.

- Technology integration enables seamless collaboration between clients, brokers, and insurers, leading to faster resolution of issues.

Customer Experience

When it comes to customer experience, the way insurance services are delivered can greatly impact satisfaction and loyalty. Let's explore how Embroker and traditional insurers differ in this aspect.

Embroker Personalization

Embroker stands out in personalizing its services for customers by leveraging technology to offer tailored solutions. Through data-driven insights, Embroker can better understand the unique needs of each client and provide customized insurance options that fit their specific requirements.

Ease of Use

- Embroker's digital platform offers a user-friendly interface that simplifies the insurance process, making it convenient for customers to manage their policies online. This streamlined approach enhances the overall experience and eliminates the hassle of traditional paperwork.

- In contrast, traditional insurers may still rely on manual processes and paperwork, leading to longer wait times and a more cumbersome experience for customers.

Customer Feedback

One Embroker customer praised the platform for its ease of use and transparency, stating, "Embroker made it so simple to understand my policy and make any necessary changes. It was a breath of fresh air compared to my previous experiences with traditional insurers."

On the other hand, a customer of a traditional insurer expressed frustration with the lengthy claims process and lack of communication, highlighting the need for improvement in customer service.

Product Offerings

When it comes to product offerings, Embroker and traditional insurers have differences in the range of insurance products they provide and how they cater to specific industries or sectors. Let's delve into the details.

Range of Insurance Products

Embroker offers a variety of insurance products, including but not limited to cyber insurance, directors and officers (D&O) liability insurance, errors and omissions (E&O) insurance, and employment practices liability insurance. On the other hand, traditional insurers typically offer a broader range of insurance products, covering everything from property and casualty to life and health insurance.

Unique or Specialized Insurance Products

Embroker stands out by offering unique and specialized insurance products tailored to specific industries or sectors. For example, Embroker provides customizable insurance solutions for technology startups, fintech companies, and professional service firms. This specialized approach allows Embroker to address the unique risks and challenges faced by these industries.

Pricing Strategies

In terms of pricing strategies, Embroker often leverages technology to streamline processes and offer competitive pricing to its customers. By utilizing data analytics and automation, Embroker can provide more accurate pricing based on individual risk profiles. Traditional insurers, on the other hand, may rely on more traditional underwriting methods, which can sometimes result in higher premiums.

Industry Specific Coverage

Embroker caters to a wide range of industries with its products, including technology, finance, healthcare, and professional services. By offering industry-specific coverage options, Embroker can provide tailored insurance solutions that address the unique needs of each sector. This targeted approach ensures that businesses receive comprehensive coverage that is relevant to their industry.

Final Conclusion

In conclusion, the comparison between Embroker and traditional insurers showcases a dynamic shift in how insurance services are delivered and experienced. With a focus on technology, customer-centric services, and a diverse range of products, Embroker stands out as a formidable force reshaping the insurance sector for the better.

FAQ

How does Embroker differ from traditional insurers?

Embroker distinguishes itself through its innovative business model that leverages technology to streamline insurance processes and enhance customer experience.

What unique insurance products does Embroker offer?

Embroker offers specialized insurance products tailored to specific industries or sectors, providing customized coverage options not typically found with traditional insurers.

How does technology impact the efficiency of insurance processes at Embroker?

Technology integration at Embroker significantly improves the efficiency of insurance processes, leading to quicker response times and smoother transactions for customers.