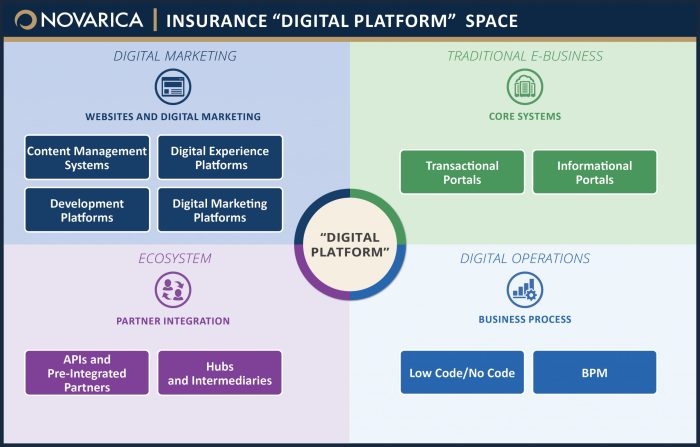

Exploring the realm of insurance for startups, digital platforms play a crucial role in providing innovative solutions tailored to their unique needs. This article delves into the world of digital platforms offering insurance for startups, shedding light on the benefits and customization options available.

Overview of Digital Platforms Offering Insurance for Startups

Digital platforms offering insurance for startups have revolutionized the way new businesses protect themselves from risks and uncertainties. These platforms provide a convenient and efficient way for startups to access a wide range of insurance products tailored to their specific needs.

Startups benefit from using digital platforms for insurance in several ways. Firstly, they can compare different insurance options easily and choose the one that best fits their requirements and budget. Secondly, the streamlined process of purchasing insurance online saves startups valuable time and resources, allowing them to focus on growing their business.

Additionally, digital platforms often offer competitive pricing and transparent terms, making insurance more accessible to startups with limited financial resources.

Examples of Well-Known Digital Platforms for Startups’ Insurance Needs

- 1. Next Insurance:Next Insurance is a popular digital platform that offers a variety of insurance products specifically designed for small businesses and startups. They provide easy online quotes and customizable coverage options to meet the unique needs of each startup.

- 2. Embroker:Embroker is another well-known digital platform that caters to startups looking for insurance solutions. They offer a wide range of insurance products, including general liability, professional liability, and cyber insurance, all accessible through their user-friendly online platform.

- 3. CoverWallet:CoverWallet is a digital insurance platform that simplifies the insurance buying process for startups. They provide instant quotes, personalized recommendations, and dedicated customer support to help startups find the right insurance coverage quickly and efficiently.

Types of Insurance Coverage Available on Digital Platforms

Insurance coverage is crucial for startups to protect themselves from potential risks and uncertainties. Various types of insurance are typically offered on digital platforms catering to startups, each serving a specific purpose in mitigating risks and providing financial security. Let's delve into the different types of insurance coverage available and their importance for startups.

1. General Liability Insurance

General liability insurance provides coverage for third-party claims of bodily injury, property damage, and advertising injury. It is essential for startups to protect themselves from lawsuits and financial liabilities resulting from accidents or negligence.

2. Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, protects startups from claims of negligence or inadequate work performance. This coverage is crucial for service-based startups to safeguard against financial losses due to mistakes or oversights.

3. Property Insurance

Property insurance covers physical assets owned by startups, including office space, equipment, and inventory, against damage or loss caused by fire, theft, or other covered perils. It is vital for startups to protect their valuable assets from unforeseen events.

4. Cyber Insurance

Cyber insurance provides coverage for losses resulting from data breaches, cyberattacks, and other cyber threats. In the digital age, where startups heavily rely on technology, cyber insurance is essential to protect sensitive information and mitigate financial losses due to cyber incidents.

5. Workers’ Compensation Insurance

Workers' compensation insurance is mandatory for startups with employees and covers medical expenses and lost wages for employees injured on the job. This coverage ensures that startups comply with legal requirements and take care of their employees' well-being.Each type of insurance coverage plays a vital role in safeguarding startups against various risks and uncertainties.

Comparing the coverage options available on different digital platforms can help startups choose the most suitable insurance policies tailored to their specific needs and budget.

Customization and Tailored Solutions

When it comes to insurance for startups, digital platforms offer customization and tailored solutions to meet the specific needs of each business. This flexibility allows startups to get the coverage they need without paying for unnecessary extras.

Examples of Customization Options:

- Adjusting coverage limits based on the size and nature of the startup.

- Choosing specific coverage for unique risks faced by the startup.

- Adding or removing coverage as the startup grows and evolves.

- Customizing payment plans to fit the startup's budget and cash flow.

Flexibility in Adjusting Coverage:

- Digital platforms allow startups to easily adjust their insurance coverage as their business grows or changes.

- Startups can increase coverage limits, add new types of insurance, or remove coverage that is no longer needed.

- This flexibility ensures that startups are always adequately protected without overpaying for unnecessary insurance.

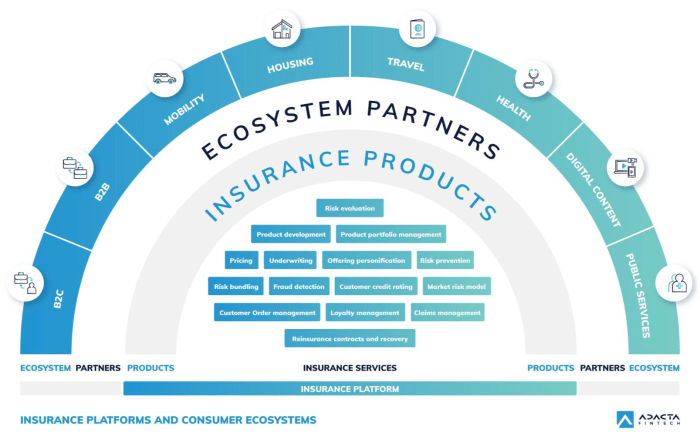

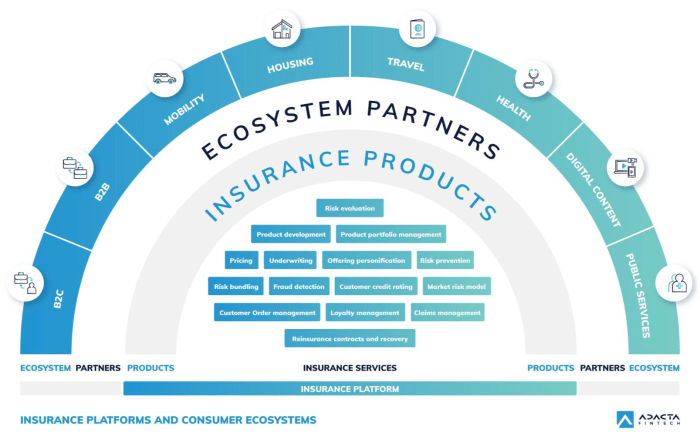

Integration with Startup Ecosystem

Digital platforms offering insurance play a crucial role in integrating with the broader startup ecosystem by providing specialized insurance solutions tailored to the unique needs of startups. These platforms often form strategic partnerships with other service providers within the startup community to offer comprehensive support for startups in managing risks and ensuring sustainable growth.

Partnerships within the Startup Community

Digital platforms offering insurance often collaborate with accelerators, incubators, venture capital firms, and other stakeholders in the startup ecosystem to provide startups with access to a wide range of insurance products and services. These partnerships enable startups to benefit from bundled offerings, discounted rates, and expert advice on risk management tailored to their specific industry and growth stage.

- Accelerators and Incubators: Digital platforms partner with accelerators and incubators to offer insurance solutions as part of their startup support programs. Startups affiliated with these organizations can access insurance products easily and receive guidance on selecting the right coverage for their needs.

- Venture Capital Firms: Many venture capital firms require startups in their portfolio to have certain insurance coverage to mitigate risks and protect their investments. Digital platforms collaborate with these firms to streamline the insurance procurement process for startups and ensure compliance with insurance requirements.

- Industry Experts: Digital platforms often work with industry experts and consultants within the startup ecosystem to develop customized insurance solutions that address the unique risks faced by startups in specific sectors such as technology, healthcare, or fintech. These partnerships ensure that startups receive tailored insurance advice and coverage that aligns with their business objectives.

Supporting Growth and Sustainability

Digital platforms offering insurance play a vital role in supporting the growth and sustainability of startups by providing them with essential risk management tools and financial protection. By offering flexible insurance products that can be easily customized and tailored to meet the evolving needs of startups, these platforms empower startups to focus on innovation and expansion without worrying about potential liabilities or unforeseen risks.

- Financial Protection: Insurance coverage provided by digital platforms safeguards startups against risks such as property damage, liability claims, cyber threats, and professional negligence. This protection gives startups the confidence to pursue new opportunities and scale their operations without fear of financial setbacks due to unforeseen events.

- Risk Management: Digital platforms offer startups access to risk assessment tools, expert advice, and educational resources to help them identify and mitigate potential risks proactively. By promoting a culture of risk awareness and prevention, these platforms enable startups to make informed decisions and protect their businesses from potential threats.

- Growth Acceleration: Through strategic partnerships and tailored insurance solutions, digital platforms contribute to the acceleration of startup growth by providing them with the necessary support to navigate regulatory requirements, attract investors, and expand their market presence. By mitigating risks and ensuring compliance, these platforms create a conducive environment for startups to thrive and achieve long-term success.

Closing Notes

In conclusion, the integration of digital platforms with the startup ecosystem opens up new avenues for growth and sustainability through insurance services. With a focus on flexibility and tailored solutions, startups can navigate risks with confidence.

General Inquiries

What types of insurance coverage are typically offered to startups?

Startups commonly have access to general liability insurance, property insurance, cyber insurance, and business interruption insurance.

How do digital platforms tailor insurance solutions for startups?

Digital platforms analyze startup needs and offer customized insurance packages that align with their specific risks and operations.

Which well-known digital platforms cater to startups' insurance needs?

Platforms like CoverWallet, Next Insurance, and Embroker are popular choices for startups seeking insurance solutions.

Exploring the realm of insurance for startups, digital platforms play a crucial role in providing innovative solutions tailored to their unique needs. This article delves into the world of digital platforms offering insurance for startups, shedding light on the benefits and customization options available.

Overview of Digital Platforms Offering Insurance for Startups

Digital platforms offering insurance for startups have revolutionized the way new businesses protect themselves from risks and uncertainties. These platforms provide a convenient and efficient way for startups to access a wide range of insurance products tailored to their specific needs.

Startups benefit from using digital platforms for insurance in several ways. Firstly, they can compare different insurance options easily and choose the one that best fits their requirements and budget. Secondly, the streamlined process of purchasing insurance online saves startups valuable time and resources, allowing them to focus on growing their business.

Additionally, digital platforms often offer competitive pricing and transparent terms, making insurance more accessible to startups with limited financial resources.

Examples of Well-Known Digital Platforms for Startups’ Insurance Needs

- 1. Next Insurance:Next Insurance is a popular digital platform that offers a variety of insurance products specifically designed for small businesses and startups. They provide easy online quotes and customizable coverage options to meet the unique needs of each startup.

- 2. Embroker:Embroker is another well-known digital platform that caters to startups looking for insurance solutions. They offer a wide range of insurance products, including general liability, professional liability, and cyber insurance, all accessible through their user-friendly online platform.

- 3. CoverWallet:CoverWallet is a digital insurance platform that simplifies the insurance buying process for startups. They provide instant quotes, personalized recommendations, and dedicated customer support to help startups find the right insurance coverage quickly and efficiently.

Types of Insurance Coverage Available on Digital Platforms

Insurance coverage is crucial for startups to protect themselves from potential risks and uncertainties. Various types of insurance are typically offered on digital platforms catering to startups, each serving a specific purpose in mitigating risks and providing financial security. Let's delve into the different types of insurance coverage available and their importance for startups.

1. General Liability Insurance

General liability insurance provides coverage for third-party claims of bodily injury, property damage, and advertising injury. It is essential for startups to protect themselves from lawsuits and financial liabilities resulting from accidents or negligence.

2. Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, protects startups from claims of negligence or inadequate work performance. This coverage is crucial for service-based startups to safeguard against financial losses due to mistakes or oversights.

3. Property Insurance

Property insurance covers physical assets owned by startups, including office space, equipment, and inventory, against damage or loss caused by fire, theft, or other covered perils. It is vital for startups to protect their valuable assets from unforeseen events.

4. Cyber Insurance

Cyber insurance provides coverage for losses resulting from data breaches, cyberattacks, and other cyber threats. In the digital age, where startups heavily rely on technology, cyber insurance is essential to protect sensitive information and mitigate financial losses due to cyber incidents.

5. Workers’ Compensation Insurance

Workers' compensation insurance is mandatory for startups with employees and covers medical expenses and lost wages for employees injured on the job. This coverage ensures that startups comply with legal requirements and take care of their employees' well-being.Each type of insurance coverage plays a vital role in safeguarding startups against various risks and uncertainties.

Comparing the coverage options available on different digital platforms can help startups choose the most suitable insurance policies tailored to their specific needs and budget.

Customization and Tailored Solutions

When it comes to insurance for startups, digital platforms offer customization and tailored solutions to meet the specific needs of each business. This flexibility allows startups to get the coverage they need without paying for unnecessary extras.

Examples of Customization Options:

- Adjusting coverage limits based on the size and nature of the startup.

- Choosing specific coverage for unique risks faced by the startup.

- Adding or removing coverage as the startup grows and evolves.

- Customizing payment plans to fit the startup's budget and cash flow.

Flexibility in Adjusting Coverage:

- Digital platforms allow startups to easily adjust their insurance coverage as their business grows or changes.

- Startups can increase coverage limits, add new types of insurance, or remove coverage that is no longer needed.

- This flexibility ensures that startups are always adequately protected without overpaying for unnecessary insurance.

Integration with Startup Ecosystem

Digital platforms offering insurance play a crucial role in integrating with the broader startup ecosystem by providing specialized insurance solutions tailored to the unique needs of startups. These platforms often form strategic partnerships with other service providers within the startup community to offer comprehensive support for startups in managing risks and ensuring sustainable growth.

Partnerships within the Startup Community

Digital platforms offering insurance often collaborate with accelerators, incubators, venture capital firms, and other stakeholders in the startup ecosystem to provide startups with access to a wide range of insurance products and services. These partnerships enable startups to benefit from bundled offerings, discounted rates, and expert advice on risk management tailored to their specific industry and growth stage.

- Accelerators and Incubators: Digital platforms partner with accelerators and incubators to offer insurance solutions as part of their startup support programs. Startups affiliated with these organizations can access insurance products easily and receive guidance on selecting the right coverage for their needs.

- Venture Capital Firms: Many venture capital firms require startups in their portfolio to have certain insurance coverage to mitigate risks and protect their investments. Digital platforms collaborate with these firms to streamline the insurance procurement process for startups and ensure compliance with insurance requirements.

- Industry Experts: Digital platforms often work with industry experts and consultants within the startup ecosystem to develop customized insurance solutions that address the unique risks faced by startups in specific sectors such as technology, healthcare, or fintech. These partnerships ensure that startups receive tailored insurance advice and coverage that aligns with their business objectives.

Supporting Growth and Sustainability

Digital platforms offering insurance play a vital role in supporting the growth and sustainability of startups by providing them with essential risk management tools and financial protection. By offering flexible insurance products that can be easily customized and tailored to meet the evolving needs of startups, these platforms empower startups to focus on innovation and expansion without worrying about potential liabilities or unforeseen risks.

- Financial Protection: Insurance coverage provided by digital platforms safeguards startups against risks such as property damage, liability claims, cyber threats, and professional negligence. This protection gives startups the confidence to pursue new opportunities and scale their operations without fear of financial setbacks due to unforeseen events.

- Risk Management: Digital platforms offer startups access to risk assessment tools, expert advice, and educational resources to help them identify and mitigate potential risks proactively. By promoting a culture of risk awareness and prevention, these platforms enable startups to make informed decisions and protect their businesses from potential threats.

- Growth Acceleration: Through strategic partnerships and tailored insurance solutions, digital platforms contribute to the acceleration of startup growth by providing them with the necessary support to navigate regulatory requirements, attract investors, and expand their market presence. By mitigating risks and ensuring compliance, these platforms create a conducive environment for startups to thrive and achieve long-term success.

Closing Notes

In conclusion, the integration of digital platforms with the startup ecosystem opens up new avenues for growth and sustainability through insurance services. With a focus on flexibility and tailored solutions, startups can navigate risks with confidence.

General Inquiries

What types of insurance coverage are typically offered to startups?

Startups commonly have access to general liability insurance, property insurance, cyber insurance, and business interruption insurance.

How do digital platforms tailor insurance solutions for startups?

Digital platforms analyze startup needs and offer customized insurance packages that align with their specific risks and operations.

Which well-known digital platforms cater to startups' insurance needs?

Platforms like CoverWallet, Next Insurance, and Embroker are popular choices for startups seeking insurance solutions.