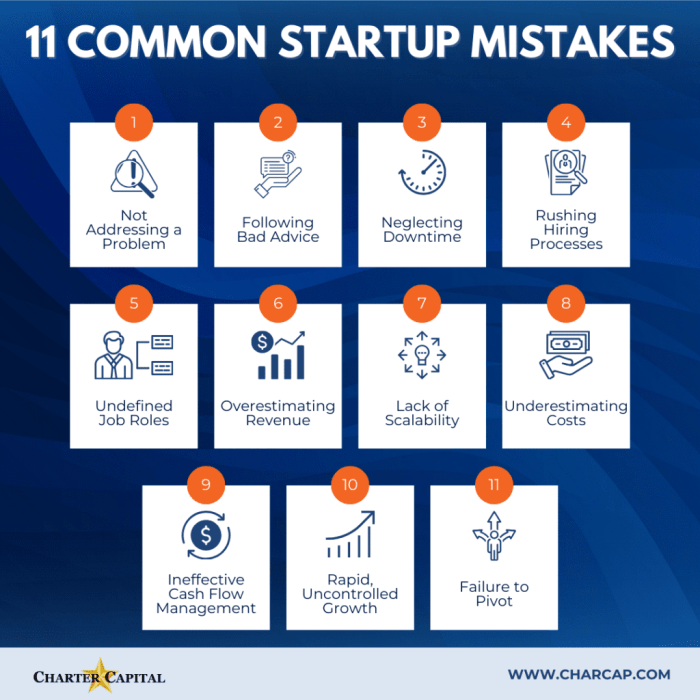

Embarking on a new startup venture can be an exciting but challenging journey. In this guide, we delve into the common mistakes that many startups make and provide valuable insights on how to steer clear of these pitfalls. From inadequate market research to premature scaling, discover key strategies to set your business up for success.

Common Mistakes to Avoid in a Startup Business

Starting a new business can be exciting, but it's important to be aware of common mistakes that can hinder the success of a startup. By identifying these pitfalls early on, entrepreneurs can take steps to avoid them and increase their chances of building a thriving business.

1. Lack of Market Research

One of the top mistakes that startups make is failing to conduct thorough market research before launching their product or service. Without a clear understanding of their target market, competitors, and industry trends, startups can struggle to attract customers and differentiate themselves.

For example, a tech startup may invest heavily in developing a new app without realizing that there are already similar apps dominating the market.

2. Ignoring Financial Planning

Another common mistake is neglecting proper financial planning. Startups often underestimate the costs involved in running a business and overestimate their revenue projections. This can lead to cash flow problems and ultimately, the failure of the business. For instance, a fashion startup may spend too much on inventory without considering the slow sales season, resulting in a financial crisis.

3. Team Misalignment

Team misalignment is a critical mistake that can impact the success of a startup. When team members have conflicting visions or values, it can lead to poor communication, lack of motivation, and ultimately, the downfall of the business. For example, a startup may face challenges if the founders have different long-term goals for the company.

4. Scaling Too Quickly

Many startups make the mistake of scaling too quickly, without establishing a solid foundation first. Rapid growth can strain resources, overwhelm the team, and compromise the quality of products or services. This can result in a negative customer experience and damage the reputation of the startup.

For instance, a food delivery startup may expand to multiple cities before perfecting their delivery logistics, leading to delays and dissatisfied customers.

5. Lack of Adaptability

Lastly, a lack of adaptability is a common mistake that startups should avoid. In today's fast-paced business environment, it's crucial to be able to pivot, iterate, and respond to market changes quickly. Startups that are too rigid in their approach may miss out on opportunities or fail to address emerging challenges.

An example could be a healthcare startup that refuses to embrace telemedicine options, despite the growing demand for virtual healthcare services.By recognizing these common mistakes and implementing strategies to avoid them, startups can increase their chances of success and build a sustainable business for the long term.

Lack of Market Research

Market research is a crucial step for any startup business before launching into the market. It involves gathering and analyzing information about the target market, competitors, and industry trends to make informed decisions. Failing to conduct proper market research can lead to significant challenges and setbacks for a startup.

Importance of Conducting Market Research

Market research helps startups understand their target audience's needs, preferences, and behaviors. It provides insights into market demand, competition, pricing strategies, and potential growth opportunities. Without this knowledge, startups may struggle to attract customers, set realistic goals, or differentiate themselves from competitors.

- Identify target market segments

- Evaluate market demand and size

- Analyze competitors and their strategies

- Determine pricing and positioning strategies

Consequences of Not Understanding the Target Market

Startups that neglect market research risk entering a saturated market, misjudging customer needs, or setting unrealistic expectations. This can lead to poor product-market fit, low customer retention, and ultimately, business failure. Understanding the target market is essential for developing products/services that resonate with customers and drive sustainable growth.

- Difficulty in reaching the target audience effectively

- High customer acquisition costs

- Inability to respond to market changes

- Losing competitive advantage

Successful Startups vs. Those That Did Not Invest in Market Research

Successful startups like Airbnb and Dropbox conducted thorough market research before entering the market. They identified niche opportunities, understood customer needs, and tailored their offerings accordingly. In contrast, startups that skipped market research, like Juicero and Color Labs, faced challenges in attracting customers and sustaining growth due to poor market fit.

Market research is not a one-time activity but an ongoing process that helps startups stay relevant and competitive in the ever-changing business landscape.

Step-by-Step Guide for Conducting Effective Market Research for a Startup

- Define research objectives and goals

- Identify target market segments and demographics

- Collect data through surveys, interviews, and secondary sources

- Analyze and interpret the data to draw actionable insights

- Use findings to refine business strategies, product development, and marketing tactics

Ignoring Financial Planning

Ignoring financial planning in a startup business can lead to serious consequences. Without a detailed financial plan, a business may struggle to manage cash flow, allocate resources effectively, and achieve long-term sustainability. It is crucial for startup founders to prioritize financial planning from the outset to set a solid foundation for growth and success.

Significance of Creating a Detailed Financial Plan

Creating a detailed financial plan helps startups to:

- Set clear financial goals and objectives.

- Estimate startup costs and funding requirements.

- Identify potential revenue streams and pricing strategies.

- Monitor and control expenses to ensure profitability.

- Secure funding from investors or lenders.

Tips for Effective Financial Management in Early Stages

To effectively manage finances in the early stages of a business, startups should:

- Keep detailed records of all financial transactions.

- Separate personal and business finances.

- Monitor cash flow regularly and forecast future cash needs.

- Minimize unnecessary expenses and prioritize essential investments.

- Seek professional financial advice when needed.

Common Financial Mistakes and Their Repercussions

Common financial mistakes that startups make include:

- Underestimating startup costs, leading to cash flow problems.

- Failing to track expenses accurately, resulting in budget overruns.

- Neglecting to plan for taxes and compliance, leading to penalties.

- Relying too heavily on external funding, risking loss of control.

- Ignoring the need for a contingency fund, leaving the business vulnerable to unexpected challenges.

Financial Checklist for Startups

A financial checklist that every startup should follow includes:

- Develop a comprehensive business plan with detailed financial projections.

- Establish a budget and monitor financial performance regularly.

- Secure adequate funding to cover startup costs and initial operations.

- Set up accounting and bookkeeping systems to track income and expenses.

- Plan for taxes, insurance, and legal fees to ensure compliance.

Scaling Too Quickly

Scaling a startup too quickly can lead to various risks and challenges that may hinder its long-term success. It's essential to understand the potential pitfalls associated with rapid growth and implement strategies to ensure sustainable development without compromising quality.

Risks of Scaling Too Quickly

- Increased operational costs without proportional revenue growth.

- Strain on resources and infrastructure, leading to inefficiencies.

- Lack of proper systems and processes to support rapid expansion.

- Difficulty in maintaining quality standards and customer satisfaction.

Signs of Growing Too Fast

- Rapidly declining customer satisfaction and retention rates.

- Overwhelmed employees and high turnover rates.

- Frequent cash flow issues despite apparent growth in revenue.

- Inability to meet demand or fulfill orders on time.

Strategies for Sustainable Growth

- Focus on building a strong foundation before expanding too quickly.

- Invest in scalable technologies and systems to support growth.

- Regularly assess and adjust your business plan based on market feedback.

- Prioritize customer satisfaction and feedback to drive growth sustainably.

Case Studies of Failed Startups

-

Example 1:

Company X rapidly expanded its operations to multiple locations without adequate infrastructure in place, leading to a decline in service quality and eventual closure.

-

Example 2:

Startup Y secured significant funding for rapid scaling but failed to generate enough revenue to sustain the growth, resulting in bankruptcy.

Epilogue

As we wrap up our discussion on common mistakes to avoid in a startup business, remember that awareness and proactive planning are essential for navigating the entrepreneurial landscape. By sidestepping these pitfalls and embracing smart business practices, you can position your startup for long-term growth and sustainability.

FAQ Explained

What are the top 5 common mistakes that startups make?

The top 5 common mistakes are: lack of market research, ignoring financial planning, scaling too quickly, not understanding the target market, and failing to adapt to changing circumstances.

Why is market research important for startups?

Market research helps startups understand their target audience, competition, and industry trends, enabling them to make informed decisions and tailor their strategies for success.

How can startups effectively manage their finances in the early stages?

Startups can manage their finances effectively by creating a detailed financial plan, monitoring cash flow, controlling expenses, and seeking professional financial advice when needed.

What are the risks of scaling a startup too quickly?

Scaling too quickly can lead to financial instability, operational inefficiencies, strained resources, and potential loss of quality control, jeopardizing the long-term sustainability of the business.

Can you provide examples of startups that failed due to these common mistakes?

Yes, notable examples include Blockbuster's failure to adapt to the rise of streaming services, Pets.com's lack of understanding of their target market, and WeWork's rapid expansion leading to financial troubles.