As Startup business funding options for entrepreneurs takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Understanding the various ways entrepreneurs can fund their startup ventures is crucial for success in today's competitive business environment. From traditional funding sources to innovative alternatives, the options available can make or break a startup. Let's delve into the diverse landscape of startup business funding options and explore the key factors that entrepreneurs should consider when choosing their funding path.

Overview of Startup Business Funding Options

When starting a new business, understanding the different funding options available is crucial for entrepreneurs. It can make the difference between the success and failure of a startup. By exploring various funding sources, entrepreneurs can make informed decisions and choose the best option for their specific needs.

Importance of Understanding Different Funding Options

Entrepreneurs should consider the following key factors when choosing funding for their startup:

- Risk Tolerance:Different funding options come with varying levels of risk. Entrepreneurs need to assess their risk tolerance and choose funding that aligns with their comfort level.

- Cost of Capital:Understanding the cost associated with each funding option is essential. Whether it's equity, debt, or alternative financing, entrepreneurs need to evaluate the long-term financial implications.

- Control:Some funding sources may require giving up control or decision-making power. Entrepreneurs must weigh the trade-offs between funding and retaining control of their startup.

Comparison of Traditional Funding Sources with Alternative Options

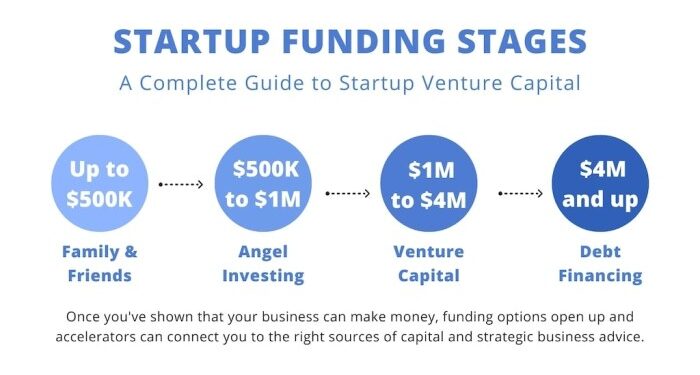

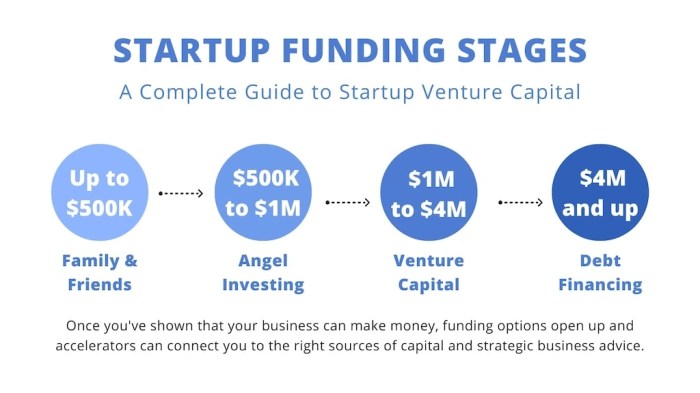

Traditional funding sources like bank loans, venture capital, and angel investors have been popular choices for entrepreneurs. However, newer alternative funding options such as crowdfunding, peer-to-peer lending, and accelerators have emerged in the market.

Alternative funding options offer more flexibility, faster access to capital, and opportunities to connect with a wider network of investors.

Bootstrapping as a Funding Option

Bootstrapping is a method of funding a startup by using personal savings, revenue, or other resources without external help. This approach allows entrepreneurs to maintain full control over their business and decision-making processes.

Examples of Successful Bootstrapped Companies

- Zapier: This automation tool started as a side project and was bootstrapped until it reached profitability, allowing the founders to retain ownership.

- Mailchimp: The popular email marketing platform was initially funded through a small loan and bootstrapped by its founders, leading to its success without external investors.

Advantages and Disadvantages of Bootstrapping

- Advantages:

1. Independence: Entrepreneurs can make decisions without external influence.2. Control: Founders retain full control over the direction of the business. 3. Flexibility: There are no strict requirements or obligations to meet for investors.

- Disadvantages:

1. Limited Resources: Growth may be slower due to restricted funds.2. Risk: Personal finances are at stake, and failure could lead to financial loss. 3. Scalability Issues: Scaling the business might be challenging without additional funding.

Angel Investors and Venture Capital

Angel investors and venture capital play a crucial role in funding startups, providing the necessary capital to help businesses grow and succeed. While both sources of funding can be vital for entrepreneurs, there are key differences between angel investors and venture capitalists.

Angel Investors

Angel investors are typically high-net-worth individuals who invest their own money into early-stage startups in exchange for equity. They often provide not only financial support but also valuable mentorship and connections to help the business succeed. Entrepreneurs can attract angel investors by having a strong business plan, a clear path to profitability, and a compelling pitch that demonstrates the potential for a high return on investment.

Venture Capitalists

Venture capitalists, on the other hand, are professional investors who manage funds from institutions or high-net-worth individuals. They invest larger amounts of money in startups in exchange for equity and play a more active role in the business, often requiring a seat on the board of directors.

Entrepreneurs looking to attract venture capital should have a scalable business model, a strong management team, and a clear exit strategy to provide investors with a lucrative return on their investment.

Key Differences

- Angel investors are individuals who invest their own money, while venture capitalists manage funds from institutions or high-net-worth individuals.

- Angel investors typically invest in early-stage startups, whereas venture capitalists often invest in more established companies with a proven track record.

- Angel investors tend to provide more hands-on mentorship and support, while venture capitalists take a more strategic and financial approach to their investments.

Crowdfunding Platforms

Crowdfunding is a way for entrepreneurs to raise funds for their startup ventures by collecting small contributions from a large number of individuals. This method has significantly impacted startup funding by democratizing access to capital and allowing founders to pitch their ideas directly to potential investors online.

Popular Crowdfunding Platforms

- Kickstarter: A well-known platform for creative projects where backers receive rewards in return for their contributions.

- Indiegogo: Offers both rewards-based and equity crowdfunding options for entrepreneurs looking to fund their projects.

- GoFundMe: Primarily used for personal causes and charitable events, but also supports entrepreneurial endeavors.

Benefits and Challenges of Crowdfunding

- Benefits:

- Access to a large pool of potential investors who believe in your idea.

- Validation of your product or service by gauging interest and receiving feedback from backers.

- Potential for viral marketing and increased brand awareness through crowdfunding campaigns.

- Challenges:

- High competition on popular platforms, making it challenging to stand out among other projects.

- Time-consuming process of creating and managing a successful crowdfunding campaign.

- Risk of not meeting funding goals and potentially damaging the reputation of the startup.

Small Business Loans and Grants

When it comes to funding options for startups, small business loans and grants can play a crucial role in providing the necessary capital. These financial resources can help entrepreneurs kickstart their ventures and bring their ideas to life.

Types of Small Business Loans and Grants

There are various types of small business loans and grants available for entrepreneurs, each with its own set of requirements and benefits. Here are some common options:

- Traditional Bank Loans:Offered by banks and financial institutions, these loans typically require a good credit score and collateral.

- SBA Loans:Backed by the Small Business Administration, these loans provide competitive rates and terms for small businesses.

- Grants:Non-repayable funds provided by government agencies, foundations, or corporations to support specific business activities.

- Microloans:Small loans offered by non-profit organizations or online lenders to help startups and small businesses.

Tips for Qualifying for Small Business Loans or Grants

Securing a small business loan or grant can be a competitive process, but there are steps you can take to increase your chances of approval:

- Prepare a solid business plan outlining your goals, target market, and financial projections.

- Maintain a good personal and business credit score to demonstrate your financial responsibility.

- Research and apply for loans or grants that align with your business needs and industry.

- Be organized and thorough in your application, providing all required documentation and information.

- Seek assistance from small business resources or consultants to navigate the application process effectively.

Concluding Remarks

In conclusion, navigating the world of startup business funding options can be challenging but rewarding. By understanding the importance of choosing the right funding method, entrepreneurs can set themselves up for success in their entrepreneurial journey. With a mix of traditional sources and modern alternatives, the possibilities are endless for those looking to fund their startup dreams.

Q&A

What are some key factors to consider when choosing funding for a startup?

Entrepreneurs should consider factors such as the amount of funding needed, the stage of their startup, the level of control they are willing to give up, and the potential for growth and scalability.

How can entrepreneurs attract angel investors or venture capital for their business?

Entrepreneurs can attract angel investors and venture capital by having a strong business plan, a compelling pitch, a solid team, and a clear vision for growth. Networking and building relationships in the startup ecosystem also play a crucial role in attracting investors.

What are some popular crowdfunding platforms available to entrepreneurs?

Some popular crowdfunding platforms for startups include Kickstarter, Indiegogo, and GoFundMe. These platforms allow entrepreneurs to raise funds from a large pool of individual investors.