Exploring the world of AI-Powered Insurance Tools for Founders, this article delves into the innovative technology shaping the insurance sector. From enhancing efficiency to simplifying insurance management tasks, AI tools are changing the game for entrepreneurs.

Introduction to AI-Powered Insurance Tools for Founders

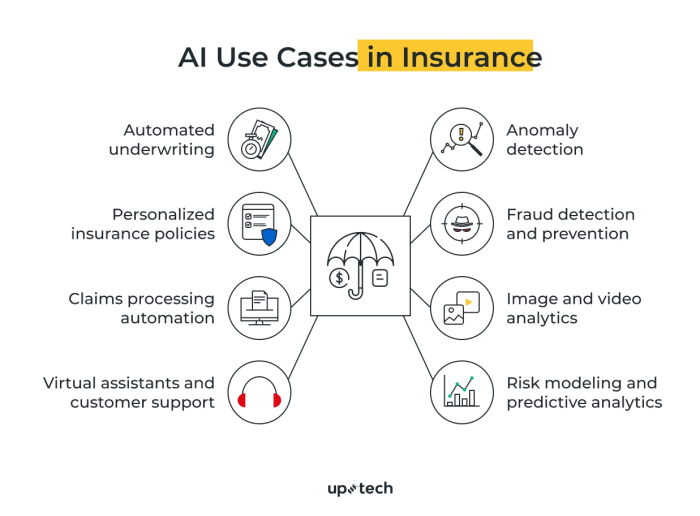

AI-powered insurance tools refer to technology-driven solutions that leverage artificial intelligence to enhance various aspects of the insurance industry. These tools utilize machine learning algorithms and data analytics to streamline processes, improve decision-making, and provide personalized services to policyholders. For founders, AI-powered insurance tools play a crucial role in optimizing risk management, reducing operational costs, and enhancing customer experience.AI technology is revolutionizing the insurance sector by automating manual tasks, predicting risk factors more accurately, and enabling faster claim processing.

Founders can benefit from these advancements by gaining access to real-time data insights, customized insurance solutions, and improved efficiency in managing their insurance needs.

Examples of Popular AI-Powered Tools for Founders in the Insurance Sector

- Lemonade: Lemonade is an AI-based insurance company that uses chatbots and machine learning algorithms to provide instant policy quotes and claims processing.

- Metromile: Metromile offers pay-per-mile car insurance using AI technology to track and analyze driving behavior, allowing founders to pay for insurance based on their actual usage.

- Oscar Health: Oscar Health utilizes AI algorithms to personalize health insurance plans, offer virtual consultations, and predict healthcare trends for its members.

Benefits of AI-Powered Insurance Tools

Using AI-powered tools in managing insurance needs offers several advantages for founders. These tools leverage artificial intelligence to enhance efficiency, accuracy, and decision-making processes, ultimately benefiting entrepreneurs in various aspects of insurance management.

Enhanced Efficiency

AI-powered insurance tools streamline and automate many processes, saving founders time and resources. By utilizing AI algorithms, tasks such as data collection, risk assessment, and policy comparisons can be performed much faster than manual methods. This increased efficiency allows founders to focus on other aspects of their business without compromising on the quality of insurance management.

Improved Accuracy

AI tools are equipped to analyze vast amounts of data with precision, reducing the chances of errors or inaccuracies in insurance-related tasks. By using advanced algorithms, these tools can provide founders with more accurate risk assessments, personalized policy recommendations, and data-driven insights for better decision-making.

This heightened accuracy minimizes the potential for misunderstandings or oversights in insurance processes.

Enhanced Decision-Making

AI-powered insurance tools offer founders valuable insights and analytics to support informed decision-making. By leveraging data analytics and predictive modeling, these tools can help founders assess risks more effectively, customize insurance policies to meet specific needs, and optimize claims processing.

This data-driven approach empowers founders to make strategic decisions that align with their business goals and risk management strategies.

Key Features of AI-Powered Insurance Tools

AI-powered insurance tools come with a range of features that cater to the specific needs of founders, making insurance management more efficient and effective. These tools leverage artificial intelligence to streamline processes, enhance decision-making, and provide personalized solutions for startups.

Data Analytics and Risk Assessment

AI-powered insurance tools analyze vast amounts of data in real-time to assess risks accurately. By utilizing advanced algorithms, these tools can identify potential risks and predict future outcomes, allowing founders to make informed decisions regarding their insurance coverage.

Customized Insurance Plans

These tools offer personalized insurance plans based on the unique requirements of each startup. By considering factors such as industry type, business size, and risk profile, AI-powered tools can tailor insurance packages that provide comprehensive coverage while optimizing costs.

Claims Processing Automation

One of the key features of AI-powered insurance tools is the automation of claims processing. By automating this time-consuming task, founders can expedite the claims settlement process, reducing paperwork and minimizing the chances of errors or delays.

24/7 Support and Assistance

AI-powered insurance tools provide round-the-clock support and assistance to founders, ensuring prompt responses to queries and concerns. Through chatbots and virtual assistants, these tools offer instant help and guidance, enhancing the overall customer experience.

Risk Management Alerts

These tools proactively monitor risks and alert founders about potential threats to their business

Implementation and Integration of AI Tools

AI-powered insurance tools can revolutionize the way startups manage their insurance operations. Integrating these tools into existing systems requires careful planning and consideration to ensure a seamless transition. Let's explore some insights, challenges, and best practices for implementing AI tools in the insurance industry.

Integrating AI-Powered Insurance Tools

Integrating AI-powered insurance tools into existing systems can be a game-changer for startups looking to streamline their operations. Founders can follow these steps to ensure a smooth integration process:

- Evaluate existing systems: Before implementing AI tools, founders should assess their current systems to identify gaps and areas that can benefit from automation.

- Choose the right tool: Select an AI-powered insurance tool that aligns with the specific needs and goals of the startup, ensuring compatibility with existing systems.

- Collaborate with IT experts: Work closely with IT professionals to integrate the AI tool effectively, ensuring data security and seamless operation.

- Provide training: Train employees on how to use the new AI tool to maximize its benefits and improve efficiency in insurance operations.

Challenges and Considerations

Implementing AI tools for insurance purposes comes with its own set of challenges and considerations that founders need to address:

- Data privacy and security: Ensuring the protection of sensitive customer data is crucial when implementing AI tools in insurance operations.

- Regulatory compliance: Compliance with industry regulations and standards is essential to avoid legal issues and maintain trust with customers.

- Integration complexity: Integrating AI tools with existing systems can be complex and time-consuming, requiring careful planning and coordination.

- Cost implications: Investing in AI tools can be costly, and founders need to consider the return on investment and long-term benefits.

Best Practices for Utilizing AI Technology

To make the most of AI technology in insurance operations, startups can follow these best practices:

- Start small: Begin with pilot projects to test the effectiveness of AI tools before scaling up implementation across the organization.

- Monitor performance: Regularly monitor the performance of AI tools and adjust strategies as needed to optimize results and improve efficiency.

- Embrace automation: Embrace automation in insurance processes to reduce manual tasks, improve accuracy, and enhance customer experience.

- Stay updated: Keep abreast of the latest developments in AI technology and insurance trends to stay ahead of the competition and drive innovation.

Closing Notes

In conclusion, AI-Powered Insurance Tools offer founders a new way to manage their insurance needs effectively. With features that streamline processes and improve decision-making, these tools are a valuable asset for startup success in the insurance realm.

Quick FAQs

How do AI-powered insurance tools benefit founders?

AI tools benefit founders by enhancing efficiency, accuracy, and decision-making processes in managing insurance needs.

What are some popular AI-powered tools available for founders in the insurance sector?

Some popular AI-powered tools for founders in the insurance sector include Lemonade, Hippo, and PolicyGenius.

How can founders integrate AI tools into their existing systems?

Founders can integrate AI tools into their existing systems by understanding the challenges, considerations, and best practices for seamless integration.