Embark on a journey through the realm of financial tools for startup scaling with Brex vs Vouch. Delve into the distinctive features and benefits that set these platforms apart, promising an enlightening exploration for readers seeking insight into the startup ecosystem.

Explore the nuances of pricing models, user experiences, and customer support offered by Brex and Vouch, unveiling a comprehensive comparison that unveils the ideal financial companion for startups navigating the path to success.

Introduction to Brex and Vouch

Brex and Vouch are two prominent financial tools tailored for startups to navigate the challenges of scaling and growth. Each platform offers unique services to support the financial needs of emerging businesses, catering to specific audiences and providing distinct features to aid in the journey of startup scaling.

Core Services Provided by Brex and Vouch

- Brex: Brex provides corporate credit cards designed specifically for startups, offering high credit limits, rewards tailored to business needs, and streamlined expense management tools.

- Vouch: Vouch focuses on providing insurance solutions for startups, including coverage for technology errors, omissions, and cyber liability, safeguarding businesses against potential risks.

Target Audience

- Brex: Brex targets early-stage startups looking for efficient credit card solutions and expense management tools to optimize their financial operations.

- Vouch: Vouch caters to startups in need of comprehensive insurance coverage to protect their business assets and mitigate potential risks in the fast-paced startup environment.

Unique Features for Startup Scaling

- Brex: Brex stands out with its ability to provide high credit limits based on funding rounds, no personal guarantee requirements, and integrations with popular accounting software for seamless financial management.

- Vouch: Vouch offers unique insurance products tailored to startup needs, including coverage for intellectual property infringement, data breaches, and tailored policies based on the industry and risk profile of the business.

Brex vs Vouch: Pricing Models

When it comes to pricing, Brex and Vouch offer different structures tailored to the needs of startups. Let's explore how these pricing models can impact the scaling process for new businesses.

Brex Pricing Model

Brex offers a unique pricing model that is based on a subscription fee rather than traditional interest rates. Startups pay a monthly fee for access to Brex's financial tools, with no additional charges for transactions or international payments. This transparent pricing structure can be beneficial for startups looking to manage their expenses effectively.

Vouch Pricing Model

On the other hand, Vouch follows a more traditional approach with interest rates and fees associated with its financial services. While this may seem more familiar to some startups, it's essential to consider the potential impact of these costs on the overall budget and cash flow.

Benefits for Startups

- Brex's subscription-based pricing model provides predictability and transparency, allowing startups to budget more effectively.

- Vouch's traditional pricing structure may offer flexibility for startups that prefer a more established approach to financial services.

- Both platforms have options for rewards and benefits that can further support startups in their growth and scaling efforts.

Hidden Costs and Additional Fees

While Brex and Vouch have clear pricing models, it's essential for startups to be aware of any potential hidden costs or additional fees that may arise. For example, currency conversion fees, overdraft charges, or late payment penalties could impact the overall cost of using these platforms.

Startups must carefully review the terms and conditions to understand the full cost of utilizing Brex or Vouch for their financial needs.

Features and Benefits Comparison

When comparing the key features and benefits of Brex and Vouch, it's essential to understand how these tools can impact the financial management and growth of startups. Let's delve into the specifics to see how each platform can cater to the unique needs of entrepreneurs.

Credit Limits

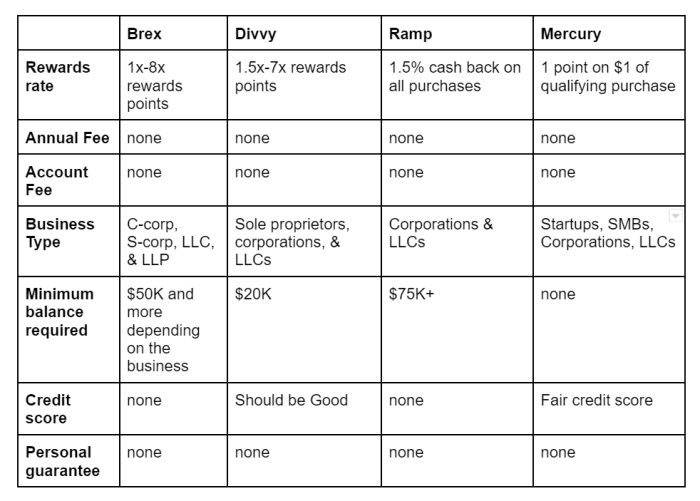

- Brex: Offers high credit limits based on the startup's funding and spending patterns.

- Vouch: Provides customizable credit limits tailored to the startup's financial needs.

Rewards

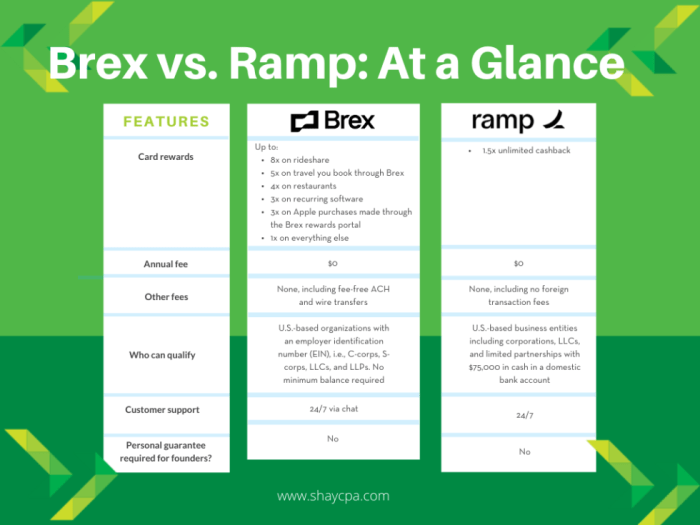

- Brex: Offers rewards such as cashback on specific categories like software subscriptions and travel.

- Vouch: Provides rewards in the form of cashback or discounts on business-related expenses.

Integrations

- Brex: Integrates with popular accounting software and expense management tools for seamless financial tracking.

- Vouch: Offers integrations with various financial platforms to streamline expense reporting and budgeting.

Support

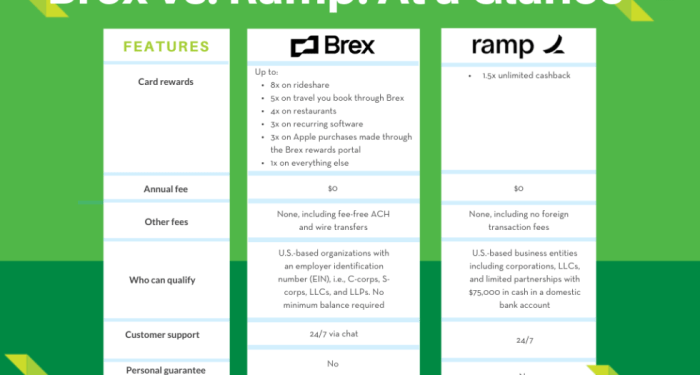

- Brex: Provides 24/7 customer support and dedicated account management for personalized assistance.

- Vouch: Offers responsive customer support and financial advice to help startups navigate their financial challenges.

Success Stories

One success story involves a startup that used Brex to manage their expenses efficiently, earning cashback rewards that they reinvested back into their business, fueling its growth.

Another success story showcases a startup leveraging Vouch's customizable credit limits to fund a new project, leading to increased revenue and market expansion.

User Experience and Customer Support

When it comes to using financial tools for startup scaling like Brex and Vouch, the user experience and customer support play a crucial role in ensuring smooth operations and addressing any issues that may arise along the way.

User Experience with Brex and Vouch

- Startups using Brex often praise the platform for its user-friendly interface and seamless integration with various financial tools and services. The dashboard is intuitive and provides easy access to essential financial information.

- On the other hand, Vouch is known for its personalized approach, offering tailored solutions based on the specific needs of each startup. Users appreciate the customization options and the ability to adapt the platform to their unique requirements.

Customer Support Options

- Brex offers 24/7 customer support via chat and email, ensuring that startups can get assistance whenever they need it. The support team is knowledgeable and responsive, helping users resolve issues promptly.

- Vouch provides dedicated account managers to each startup, offering personalized support and guidance throughout the scaling process. This hands-on approach is highly valued by users who appreciate the individual attention and expertise.

Feedback from Startup Founders

One startup founder mentioned that Brex's customer support team went above and beyond to help them navigate a complex financial situation, showing dedication and expertise.

Another founder shared how Vouch's personalized support helped them optimize their financial strategies and streamline their operations, leading to significant growth and success.

Concluding Remarks

Concluding our discussion on Brex vs Vouch: Financial Tools for Startup Scaling, it becomes evident that the right choice in financial tools can shape the trajectory of a startup's growth. By weighing the unique attributes and advantages of each platform, startups can make informed decisions that propel them towards prosperity in the competitive business landscape.

FAQ

What are the core services offered by Brex and Vouch?

Brex focuses on providing corporate cards and financial solutions tailored for startups, while Vouch offers insurance and risk assessment services specifically designed for emerging businesses.

How do the pricing models of Brex and Vouch differ?

Brex offers a credit-based pricing structure for its services, whereas Vouch provides insurance coverage with varying premiums based on risk factors.

What are some key features that distinguish Brex from Vouch in terms of financial tools for startup scaling?

Brex emphasizes credit limits and rewards for startups, while Vouch focuses on risk mitigation through insurance products, catering to different aspects of financial management in scaling businesses.

How do startup founders rate the user experience and customer support provided by Brex and Vouch?

Feedback from startup founders indicates high satisfaction with Brex's user-friendly interface and Vouch's responsive customer support, showcasing a positive experience for users of both platforms.