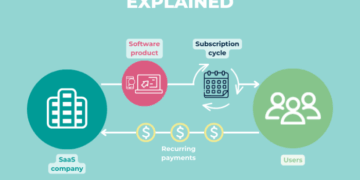

Diving into the realm of Liability Insurance Essentials for SaaS Founders, we uncover the vital aspects that every founder should know to safeguard their business. From understanding the importance of liability insurance to exploring the various types available, this guide equips SaaS founders with the knowledge needed to navigate potential risks effectively.

Importance of Liability Insurance

Liability insurance is a crucial aspect for SaaS founders as it provides protection against unforeseen risks and potential legal issues that may arise in the course of business operations.

Examples of Potential Risks Covered

- Data breaches leading to loss of sensitive customer information

- Intellectual property infringement claims from third parties

- Service outages causing financial losses for clients

Financial Implications of Not Having Liability Insurance

Not having liability insurance can result in significant financial burdens for a SaaS business, including costly legal fees, settlement payments, and damage to the company's reputation.

Key Factors for Selecting Liability Insurance Coverage

- Coverage limits that adequately protect against potential risks

- Policy exclusions and limitations to be aware of

- Premium costs and deductibles that fit within the company's budget

Types of Liability Insurance for SaaS Founders

Liability insurance is crucial for SaaS founders to protect their business from potential risks and financial losses. There are several types of liability insurance available that cater to different aspects of a SaaS business.

General Liability Insurance

General liability insurance provides coverage for third-party claims of bodily injury, property damage, and advertising injury. For SaaS founders, this type of insurance would come into play if a visitor gets injured at their office or if there is damage to a client's property during a business meeting.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, protects SaaS founders from claims of negligence, errors, or omissions in the services they provide. This type of insurance would be essential if a client sues the SaaS company for failing to deliver promised services or for errors in the software that result in financial losses.

Cyber Liability Insurance

Cyber liability insurance helps SaaS founders cover costs associated with data breaches, cyberattacks, and other cybersecurity incidents. In today's digital age, where data is a valuable asset, this type of insurance is crucial for SaaS businesses to protect sensitive information and mitigate financial losses in the event of a cyber incident.

Comprehensive Coverage

While each type of liability insurance offers specific protections, they may have limitations. General liability insurance may not cover professional errors, while professional liability insurance may not cover cyber incidents. By investing in a combination of these insurance types, SaaS founders can ensure comprehensive coverage that protects their business from a wide range of risks.

Cost-Benefit Analysis

The cost of liability insurance for SaaS founders can vary based on factors such as the size of the business, the coverage limits, and the chosen insurance provider. While the cost of insurance may seem like an added expense, the benefits of having comprehensive coverage far outweigh the potential financial losses that could result from unforeseen events.

Ultimately, investing in liability insurance is a proactive measure that can safeguard the long-term success and sustainability of a SaaS business.

Legal Requirements and Compliance

When it comes to liability insurance for SaaS businesses, there are specific legal requirements that vary depending on the jurisdiction in which the company operates. Understanding and adhering to these regulations is crucial for the overall compliance of the business.

Role of Compliance in Insurance Coverage

Compliance with regulations can greatly impact the choice of liability insurance coverage for SaaS founders. Failure to meet legal requirements can result in penalties or fines, as well as potential lawsuits in case of any incidents or claims. It is essential for SaaS businesses to align their insurance policies with the specific laws and regulations of the regions they operate in to ensure proper coverage.

Meeting Contractual Obligations

Liability insurance plays a vital role in meeting contractual obligations with clients or partners in the SaaS industry. Many clients may require proof of insurance coverage before entering into any agreements or partnerships. By having the necessary liability insurance in place, SaaS founders can demonstrate their commitment to fulfilling contractual obligations and protecting all parties involved in the business relationships.

Staying Updated on Legal Requirements

It is essential for SaaS founders to stay informed about any changes in legal requirements related to liability insurance in their jurisdictions

By staying updated and adapting their insurance coverage accordingly, SaaS founders can ensure continuous compliance with the law and mitigate any potential risks.

Claims Process and Coverage Optimization

When it comes to filing a liability insurance claim for a SaaS business, the process can vary depending on the specific policy and insurance provider. However, there are some general steps that are typically involved in the claims process.

Typical Process of Filing a Liability Insurance Claim

- Contact your insurance provider as soon as the incident occurs to report the claim.

- Provide all relevant details and documentation related to the claim, including any evidence or records.

- Cooperate with the insurance adjuster assigned to your claim and answer any questions they may have.

- Wait for the insurance company to investigate the claim and determine coverage based on the policy terms.

- If the claim is approved, the insurance company will provide compensation according to the coverage limits.

Best Practices for Optimizing Coverage and Ensuring Smooth Claims Process

It is essential to review your policy regularly to ensure it meets the evolving needs of your SaaS business.

- Keep detailed records of incidents that could lead to a claim to provide accurate information to the insurance company.

- Work closely with your insurance agent or broker to understand the coverage and any exclusions in your policy.

- Notify your insurance provider immediately of any potential claims to avoid delays in processing.

- Consider working with a legal expert to navigate complex claims that involve legal implications.

Common Pitfalls to Avoid When Filing a Liability Insurance Claim

- Failure to report the claim promptly can lead to denial of coverage.

- Not providing sufficient documentation or evidence to support the claim can result in delays or denial of the claim.

- Assuming that all incidents are covered by your policy without reviewing the specific terms and conditions.

- Ignoring communication from the insurance company or not cooperating during the claims investigation process.

Tips for SaaS Founders to Maximize Benefits of Liability Insurance Coverage

- Invest in adequate coverage that aligns with the unique risks of your SaaS business.

- Regularly assess and update your coverage limits based on the growth and changes in your business operations.

- Train your team on risk management practices to prevent potential claims and mitigate risks.

- Consider adding endorsements or riders to your policy to enhance coverage for specific risks relevant to your SaaS business.

Last Point

In conclusion, Liability Insurance Essentials for SaaS Founders serves as a crucial shield against unforeseen liabilities that could jeopardize the success of your business. By prioritizing the right coverage and staying compliant with legal requirements, founders can ensure their ventures are protected for the long haul.

Detailed FAQs

What are the key factors to consider when selecting liability insurance coverage?

Key factors include the nature of your business, potential risks involved, coverage limits, and cost implications.

How can compliance with regulations impact the choice of liability insurance coverage?

Compliance requirements can dictate the minimum coverage needed, influencing the type and extent of insurance a SaaS founder must secure.

What are the best practices for optimizing coverage when filing a liability insurance claim?

Best practices include documenting incidents thoroughly, notifying the insurer promptly, and seeking legal advice if needed to ensure a smooth claims process.